In India, mutual funds are strictly regulated by SEBI, with clearly defined structures and minimum capital.

1. Types of Mutual Funds in India

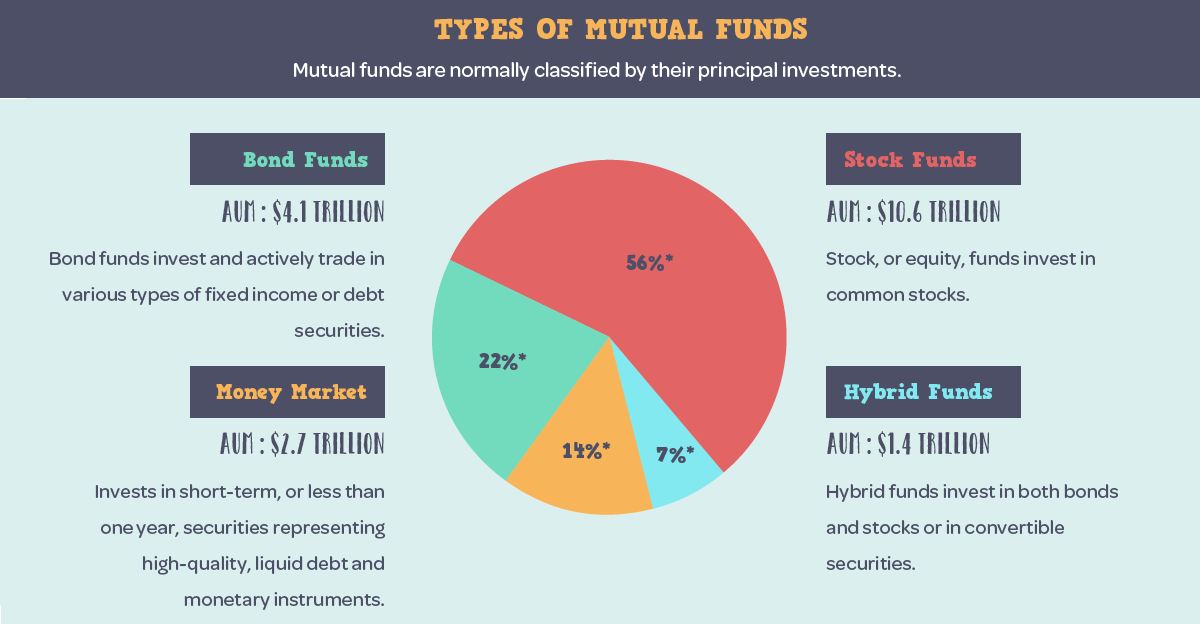

A. By Asset Class

Equity Funds: Invest in stocks; include large-cap, mid-cap, small-cap, sectoral, thematic, value, growth, ELSS (tax-saving), contra, and more.

Debt Funds: Invest in fixed-income securities—government/corporate bonds, Gilt, liquid funds, fixed maturity.

Hybrid Funds: Mix equity and debt for balanced risk—conservative, aggressive, dynamic asset allocation, multi-asset, arbitrage, equity savings.

Others: Index funds, ETFs, gold funds, real estate funds, international/emerging markets funds.

B. Specialized Strategies

Sectoral Funds: Concentrated exposure to sectors like banking, healthcare, or tech—high risk and reward

Thematic Funds: Focus on macro trends (e.g. infrastructure, sustainability)—less concentrated than sector funds, but still riskier

ELSS (Equity-Linked Savings Scheme): Equity-based with 3‑year lock-in; eligible for tax deduction ₹1.5 L under Sec 80C

2. Benefits of Investing in Mutual Funds

Diversification: Spreads risk across various assets and securities—mitigates volatility .

Professional Management: Expert managers analyze markets and select investments—ideal for investors lacking time or expertise .

Liquidity & Flexibility: Open‑ended funds enable purchases and redemptions at NAV on most business days; ELSS has just a 3‑year lock-in.

Tax Efficiency:

- ELSS: Up to ₹1.5 L deduction under 80C.

- Equity LTCG above ₹1.25 L taxed at 12.5%; debt LTCG after 3 years benefits from indexation

- Systematic Investment Plans (SIPs): Discipline and cost averaging—great for long-term goals.

3. What Harm Can Come? Risks Involved

Market Risk: Equity funds react violently to market shifts—no guarantee of returns.

Interest‑Rate & Credit Risk: Debt funds are vulnerable to rate changes or defaults.

Liquidity Risk: Lock-ins (ELSS) or a lack of buyers (certain ETFs) may prevent timely redemption.

Concentration & Theme Risk: Sectoral and thematic funds may suffer if the theme underperforms; more risk through increased consistency seen in domestic retail flows.

Expense Ratio & Hidden Costs: Active funds may have high fees, exit loads, and higher costs than passive alternatives.

Inflation & Currency Risk: Debt yields may be eroded by inflation; foreign and international funds add currency risk.

4. Indian Market Landscape & Trends

India’s mutual fund AUM crossed ₹66.7 T by Aug 2024, driven by equity fund inflows (~₹382 B in August) and booming SIP contributions (14+ months of record levels) . Despite foreign capital ebbing, domestic retail investors now account for over 26% of the market, fueling resilience

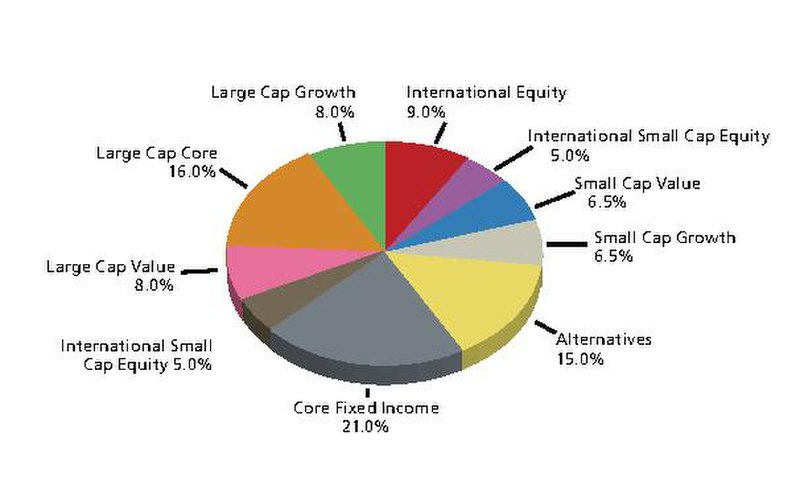

Currently, experts recommend combining flexi/mid‑cap and large‑cap equity funds with short‑duration debt or arbitrage funds, while also onsidering multi‑asset or gold funds to cushion volatility.

5. Smart Tips for Investors

Set clear goals: Short-term (liquid/tax-free debt), long-term (equity/hybrid).

Choose funds wisely: Check fund manager track record, theme lifespan, expense ratios

Use SIPs: Regular investing lowers entry timing risk.

Stay diversified: Mix large/mid/small/hybrid/tax‑saving/gold.

Monitor periodically: Watch inflows, performance trends, market outlook, risk exposures.

Mutual funds offer accessible, professionally managed and diversified exposure to India’s vibrant economy. With measured planning, balanced asset allocation, and awareness of inherent risks, they remain powerful tools for building long‑term wealth.